smart money card requirements Experian Smart Money™ is a new digital checking account and debit card that . $12.17

0 · Experian Smart Money™ Digital Checking Account FAQ

1 · Experian Smart Money™

2 · Experian Smart Money Review 2024

Insert the amiibo figure into the NFC reader: To use amiibo, you’ll need to insert the figure into the NFC reader located on the 3DS console or a Nintendo 3DS NFC card .It doesn't let you emulate amiibos, it let's the system use them. The o3ds doesn't have a NFC reader built in. If you want a cheap device that let's you emulate amiibos look up the amiibo power saves at GameStop. They are $15 and come with a puck you can flash to be any amiibo, .

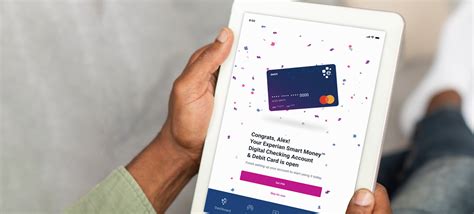

Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.

Experian Smart Money™ is a new digital checking account and debit card that .Experian Smart Money™ is a new digital checking account and debit card that .There are no monthly fees, and no minimum balance required to open an Experian Smart Money™ Digital Checking Account. Generally, we don't charge you any fees to move money .Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.

There are no monthly fees, and no minimum balance required to open an Experian Smart Money™ Digital Checking Account. Generally, we don't charge you any fees to move money in or out of your account, set up direct deposit, make transfers or pay bills. There are fees to deposit cash, make foreign transactions and get cash at out-of-network ATMs.

Experian Smart Money™ Digital Checking Account FAQ

Experian Smart Money™

Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network. Experian Smart Money is a digital checking account and debit card that aims to help you build your credit score. The account offers access to 55,000+ fee-free ATMs worldwide, early direct. The Experian Smart Money™ Digital Checking Account is built for consumers looking for a streamlined financial experience to bolster their credit strength and overall financial health with more personalized benefits.

This digital checking account can help you build credit without going into debt. Normally you build credit by responsibly using credit products such as installment loans and credit cards. But. Experian Smart Money Digital Checking Account Overview. Experian’s Smart Money Digital Checking account comes with no minimum balance requirements or monthly fees. While that’s a nice start, the checking account really stands out by offering a way to build your credit without taking on debt. Experian Smart Money is a digital checking account that's included with a free Experian membership. Smart Money makes it easy to spend in person or online, and deposits are FDIC-insured.

Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost®, which gives you credit for eligible bill payments. Some of its standout benefits include no monthly fees and access to more than 55,000 fee-free ATMs.Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.

Experian Smart Money Review 2024

There are no monthly fees, and no minimum balance required to open an Experian Smart Money™ Digital Checking Account. Generally, we don't charge you any fees to move money in or out of your account, set up direct deposit, make transfers or pay bills. There are fees to deposit cash, make foreign transactions and get cash at out-of-network ATMs. Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide.

The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network. Experian Smart Money is a digital checking account and debit card that aims to help you build your credit score. The account offers access to 55,000+ fee-free ATMs worldwide, early direct. The Experian Smart Money™ Digital Checking Account is built for consumers looking for a streamlined financial experience to bolster their credit strength and overall financial health with more personalized benefits. This digital checking account can help you build credit without going into debt. Normally you build credit by responsibly using credit products such as installment loans and credit cards. But.

contactless card tube

Experian Smart Money Digital Checking Account Overview. Experian’s Smart Money Digital Checking account comes with no minimum balance requirements or monthly fees. While that’s a nice start, the checking account really stands out by offering a way to build your credit without taking on debt. Experian Smart Money is a digital checking account that's included with a free Experian membership. Smart Money makes it easy to spend in person or online, and deposits are FDIC-insured.

While BLE requires active radios in both phone and reader, the NFC tag is powered by the credential reader’s magnetic field and doesn’t place a significant load — or potentially any load at all — on the phone’s battery. The .

smart money card requirements|Experian Smart Money™ Digital Checking Account FAQ